The Lagos State Government has reacted to claims by popular TikTok content creator, Habeeb Hamzat, also known as Peller, over a N36 million tax demand allegedly issued to him.

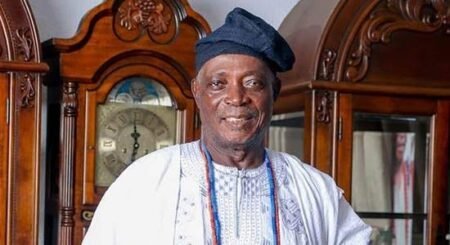

The Special Adviser to the Governor on Tax and Revenue, Abdulkabir Ogungbo, stated that the Lagos State Internal Revenue Service, LIRS, remains responsible for making fair judgments on tax matters.

Peller, who rose to fame in 2024, had in a viral video during a livestream with singer Tobechukwu Okoh, also known as Peruzzi, criticised the government over what he described as excessive taxation.

He said, “The task force said I should pay N36m in tax. I swear to Almighty Allah, I don’t have anything. I only came into the limelight last year. Are you, Peruzzi, even paying tax, and how much is it? Why should I pay N36m? What does that even mean? Why will the government take money from me when it has never given me anything, not even TikTok support, let alone help from a task force member?”

Reacting on Tuesday, Ogungbo noted that while he would review the specific details of Peller’s case, all individuals earning income in the state are required to pay taxes.

He said, “I need to take a look at this particular context in question. But generally, the LIRS is an autonomous body saddled with the responsibility of assessing and giving the best judgment on behalf of the government. We may need to engage the LIRS as an office to know about this particular case. But within the context of personal income, anybody who is legitimately earning, Section 24 of the Nigerian Constitution stipulates that when you earn your living and income legitimately, you are meant to declare that honestly to the authorities. So the context around the size, the quantum and what have you, needs to be properly investigated and we can revert.”

Addressing taxation for digital creators, Ogungbo explained that recent reforms now cover virtual transactions.

He said, “Naturally, the law allows for personal income tax, meaning that when you earn a living or earn anything from what you do legitimately, you are supposed to pay tax. So from that context, irrespective of the location, either virtually or physically, you’re meant to remit your tax to the approved authority, which is the LIRS. But from the context of around digital assets and their complementary vocations, which mainly talk about this virtual transaction, the new reforms take care of that. But as it relates to personal income tax, irrespective, you’re meant to pay tax.”

Ogungbo added, “So it’s about the legitimacy of your residence, where you stay. When you stay here, we assume that your infrastructure usage and otherwise, you earn it. You can be here and be having online business, so for that reason, if you earn honestly here, and there is no proof that you pay the same tax to another jurisdiction, for instance, maybe you’re based outside the country, you have to prove to the authority here that you were paying to the other state or other national. But if your income, which you earn here virtually or online and you stay here, and you want to do something with the Lagos State Government, then you’re bound to remit your tax here.

But I do not have this particular case on my table for me to determine. Because we have a body (the LIRS) that is autonomous and that is very efficient in what they do. So Let me investigate and revert to you.”

Meanwhile, the LIRS has yet to officially respond to the matter. Efforts to reach the agency’s Head of Corporate Communications, Monsurat Amasa, were unsuccessful as calls and messages sent on Monday and Tuesday were not answered.