India’s central bank has slashed interest rates for the first time in nearly five years to combat weakening growth in Asia’s third largest economy.

The Reserve Bank of India (RBI) decreased its repo rate from 6.5% to 6.25%, as expected by many experts.

The repo rate is the rate at which the central bank loans to commercial banks.

The latest drop comes as India’s GDP growth is expected to slump to a four-year low of 6.7%.

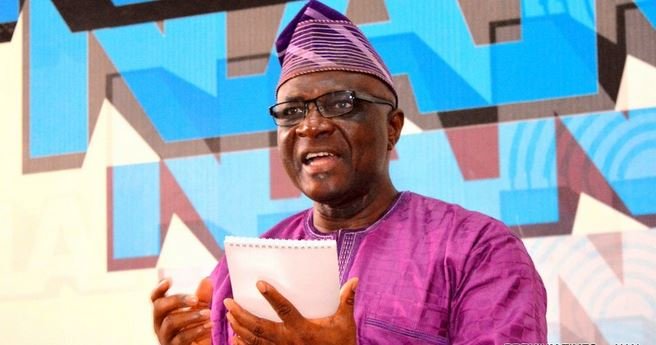

RBI Governor Sanjay Malhotra stated that the bank’s monetary stance would remain “neutral,” allowing for more room to assist growth and foreshadowing more rate decreases.

Investment growth and urban consumption in the world’s fastest-growing major economy have slowed. Corporate profits have also declined in the first half of the fiscal year.

However, Mr. Malhotra believes that moderate inflation, increased rural consumption, and strong agricultural output would all contribute to growth.

The rate drop could result in somewhat reduced mortgage and credit card interest rates, as well as lower borrowing costs for businesses.

The central bank’s rate cut comes after a series of previously announced measures, including an infusion of $18 billion (£14.48 billion) into the domestic banking system to alleviate the economy’s cash crisis.

It also reduced the cash reserve ratio, or the reserves commercial banks must hold with the RBI, by half a percent in December.

The RBI’s rate decision comes after the Union Budget’s $12 billion tax cut for the struggling middle class.

Despite this, Mr. Modi’s government intends to cut spending to lower the budget deficit. With little opportunity for fiscal stimulus, experts expect the central bank will slash interest rates by 0.5% to 1% to boost GDP, according to various estimates.

However, global concerns caused by US President Donald Trump’s tariff battle, an exodus of foreign investor money, and a falling currency—which may weaken much more if interest rates are cut—have compounded the RBI’s mission.

The Indian rupee is trading near record lows as a result of recent foreign investor outflows from the stock market.