The federal government has allegedly detained at least two senior officials from Binance, a cryptocurrency exchange company.

According to the Financial Times, both executives came into Nigeria last week following a website ban and were arrested by officers from the National Security Adviser’s office, with their passports seized.

Binance is an online exchange where users can trade cryptocurrencies.

Nigeria has one of the largest peer-to-peer cryptocurrency markets in the world. According to Chainalysis, crypto transactions in the country totaled $56.7 billion from July 2022 to June 2023.

The arrest occurred amid the government’s efforts to curb naira speculation by cracking down on cryptocurrency exchanges.

The Nigerian Communications Commission has disabled Binance and other crypto businesses’ web platforms in order to prevent what it views as ongoing forex market manipulation and illicit financial movement.

It also ordered officers from the Economic and Financial Crimes Commission to arrest Bureau de Change operators in Abuja’s Popular Wuse Zone 4.

At a press briefing on Tuesday, CBN Governor Olayemi Cardoso mentioned Binance while addressing money coming through crypto exchanges.

“We are concerned that certain practices go on that indicate illicit flows going through a number of these crypto platforms and suspicious flows at best.”

“In the case of Binance, in the last year alone, $26 billion has passed through Binance Nigeria from sources and users who we cannot adequately identify,” he added.

Cardoso stated that Nigeria’s anti-corruption agency, police, and national security adviser were coordinating an inquiry into bitcoin exchanges.

According to a person familiar with the case, the authorities have been demanding a list of Binance’s Nigerian users since its start.

In June 2023, the Securities and Exchange Commission declared Binance Nigeria Limited, a Binance subsidiary, to be operating illegally.

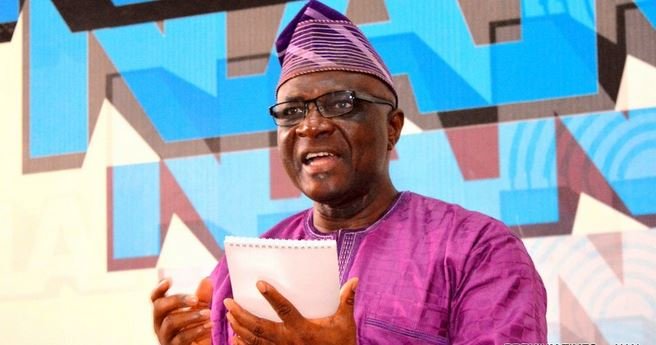

A few days earlier, Bayo Onanuga, President Bola Tinubu’s Special Adviser on Information and Strategy, tweeted certain information on X, endorsing a move that may be interpreted as confirmation of the development.

He has asked for a ban on Binance and other cryptocurrency platforms operating in Nigeria in order to reduce foreign exchange rate distortions.

Attempts to contact the Head of Strategic Communication, Office of the National Security Adviser, Zakari Mijinyawa, for confirmation were unsuccessful because he did not answer WhatsApp or text messages sent to his number.

Meanwhile, a presidential spokesman, Bayo Onanuga, has warned that if cryptocurrency trading website Binance is not blocked, it will ruin the Nigerian economy by arbitrarily fixing foreign exchange rates.

While affirming that the government has taken strict measures against the website, Onanuga emphasised that the saboteurs exploited the internet to dictate our exchange rate, effectively hijacking the role of the CBN.

Onanuga spoke on Channels Television’s Politics Today broadcast on Wednesday and said, “If we don’t clamp down on Binance, Binance will destroy the economy of this country. They just fix the rate.”

“We have saboteurs. Look at what Binance is doing to our economy. That is why the government moved against Binance. Some people sit down using cyberspace to dictate even our exchange rate, hijacking the role of the CBN.

“They just sit down and fix anything they like. It’s sabotage, and we are trying to prevent that from happening henceforth.”

The presidential adviser also asked Nigerians to cease using the secondary market for foreign exchange rates, claiming that the central bank’s website was the only legal outlet.

“The parallel market is not the real gauge of Nigeria’s economic health. The parallel market is an illegal market.

“I don’t even know why Nigerians and the media are feeding on the parallel market. That is not where we should go; what’s the CBN rate? As of Friday, the rate for the dollar was about N1600.

“Even in the so-called parallel market, the exchange rate is stabilising there, and that is what this needs. Our economy is too dollarized. Importers are looking at the exchange rate and using it to fix prices—some of them arbitrarily, some of them actually profiteering,” Onanuga stated.

According to Onanuga, once the CBN succeeds in stabilising the exchange rate, the prices of goods in the country will normalise. “Things are not going to get worse; they are going to get better in the next few weeks,” he noted.