The Asset Management Corporation of Nigeria (AMCON) has officially confirmed the sale of the Ibadan Electricity Distribution Company (IBEDC) for a total of N100 billion.

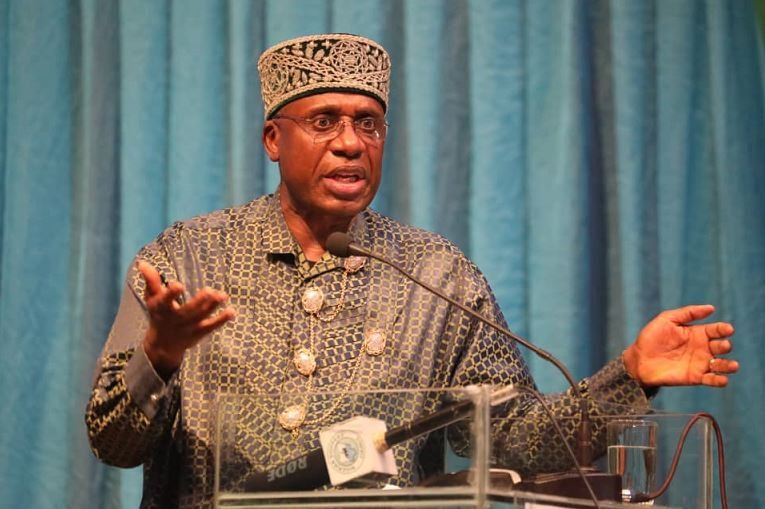

Gbenga Alake, Managing Director and Chief Executive Officer of AMCON, made the disclosure during a media parley with journalists on Thursday.

The sale of IBEDC is part of the federal government’s ongoing plan, announced in April 2024, to divest from five electricity distribution companies currently under the control of banks and AMCON.

The other companies in this category include Abuja Electricity Distribution Company (AEDC), Benin Electricity Distribution Company, Kaduna Electricity Distribution Company, and Kano Electricity Distribution Company.

Confirming the transaction, Alake stated:

“Today, I announce to you that Ibadan DisCo has been sold. When we came in, it has already been sold. It was sold for how much?”

He went on to explain that AMCON renegotiated the terms of the sale to ensure a better deal.

“We got in and said no, it cannot be. We said they should go and submit a new offer that we were not going to sell for that. At the end of the day, we got almost double of what Ibadan DisCos was going to be sold for.”

While the sale has been completed, Alake acknowledged that legal issues have emerged.

“We have sold it… and whatever is still happening in court, we will face it,” he said.

He further revealed that several parties have contested the sale and initiated lawsuits.

“So many interests now fighting and writing,” he added, though he expressed confidence in AMCON’s position.

“We are very positive that the right thing was done.”

The transaction has already sparked legal challenges. On May 15, the African Initiative Against Abuse of Public Trust, a civil society organisation, filed a suit at the Federal High Court in Abuja against AMCON, the Nigerian Electricity Regulatory Commission (NERC), the Bureau of Public Enterprises (BPE), and IBEDC.

In the suit marked FHC/ABJ/CS/866/2025, the group alleged that the proposed sale of a 60 percent stake in IBEDC for $62 million was “secretive and illegal.”

The organisation described the transaction as “corruptly undervalued,” warning that it could result in a loss of $107 million when compared to the $169 million previously paid for the same stake during the 2013 privatisation exercise.