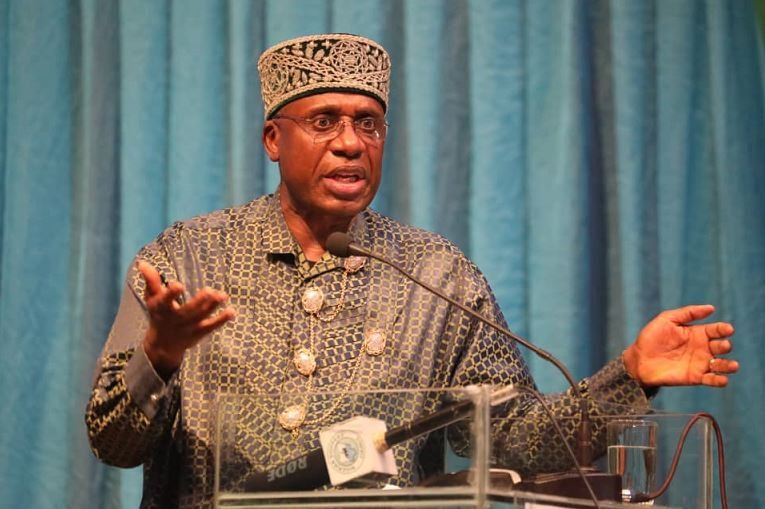

Olatunbosun Oladapo, President of the Nigerian Association of Liquefied Petroleum Gas Marketers, warned gas users to brace themselves for price increases beginning next week.

He highlighted rising international prices, high tax rates and vessel prices, currency scarcity, and naira depreciation as factors for the planned pricing revision.

“It will begin next week because international prices have risen.” Ship costs have risen, and taxes have risen, but consumers have not earned more.

“Their purchasing power has decreased.” Everyone is in tears. “Consumers, middlemen, and retailers are feeling the pinch because business is now slow,” he explained.

Olatunbosun called the impending price increase “unfortunate.”

“The situation is quite bad since prices are rising. Nigerian customers are in a terrible situation since they can no longer buy petrol’, he noted.

According to him, consumers are returning to cooking with firewood, charcoal, and sawdust.

“The government should step in and alleviate the masses’ suffering by providing palliatives and lowering taxes and levies.”

“Imagine that for every 1kg of gas priced at N700, the tax would be N3.50.” “How much is there left in this business?” He went on.

He encouraged the government to tax profits rather than products since customers were no longer purchasing gas.

“Local taxes are exacerbating the problem,” he added, urging marketers who have the option of purchasing things locally to set pricing with “consumers’ sympathy” in mind.

His reply follows the discovery that vessel scarcity in the worldwide market will drive up local costs of Liquefied Natural Gas, better known as cooking gas, in the coming months, according to reports.

Due to a lack of vessels on the international market, charter rates have risen ahead of the 2023 winter, when demand for heating fuel is expected to increase.

According to statistics from Spark Commodities cited by Bloomberg, charter prices increased to $284,750 per day for November and $206,750 per day for October as of August 1, 2023, quadrupling the existing price of $70,500 per day.

“Tanker supplies are becoming increasingly scarce as traders use the ships as floating storage in the hope that LNG prices will rise as the weather cools.”

“Volatile shipping rates can eat up margin for an LNG trader looking to cash in on higher winter prices, and rising transportation costs can ultimately mean higher prices for buyers in Europe and Asia.”

The number of LNG boats floating on the water for at least 20 days increased in late July, with 42 vessels recorded, which is around 27% more than the same period last year.

Nigerian LPG prices are internationally benchmarked and are always impacted by international pricing based on Nigerian Liquefied Natural Gas Contract prices.

Furthermore, the NLNG CP, like other globally traded commodities susceptible to price variations owing to market dynamics, is subject to change and can be evaluated higher or lower at least once to three times.

The depreciation of the local currency would have an effect on the domestic price of LPG.

According to the Central Bank of Nigeria, the dollar was worth N749.62 on Wednesday.

Nigerian LNG often sells the cooking gas it generates locally to off-takers at the current currency rate.

Inspections revealed that the rates for 20 metric tonnes of LPG at the major Apapa, Lagos, depots between July 28 and August 7 ranged between N10.7 million and N11 million, reports said.

Local cooking gas users have been enjoying inexpensive pricing for several months due to a decline in worldwide costs.

Due to the naira depreciation, the price of LPG fell from an average of N730 per kilogramme in June to roughly N600 per kilogramme in July before rising to N750 per kilogramme in August.

According to the US Energy Information Administration, the price plummeted by 76.1 percent in June to 2.10 per one million British Thermal Units on May 31 from 8.78 per one million BTU on May 31.

According to the National Bureau of Statistics, the average retail price for refilling a 5kg cylinder of cooking gas declined by 6.71 percent month on month, from N4,360.69 in May to N4,068.26 in June.

It fell 3.56 percent from N4,218.38 in June 2022 to N4,218.38 in June 2022.

Kwara had the highest average price for refilling a 5kg cylinder with N4,750.00, followed by Niger with N4,691.16 and Zamfara with N4,683.33.

Ondo, on the other hand, had the lowest price of N3,287.86, followed by Ekiti and Nasarawa, which had N3,288.46 and N3,364.62, respectively.