Nigeria’s central bank said on Tuesday it had injected $195 million into the interbank foreign exchange market, extending efforts to boost liquidity and alleviate dollar shortages.

The bank said it had released $100 million earmarked for the wholesale market, $50 million for small businesses and individuals, and $45 million for certain dollar expenses such as school fees and medical bills.

READ: Guinness Nigeria N40bn share oversubscribed

In a statement, spokesman Isaac Okorafor said the central bank would continue to intervene to sustain liquidity in the currency market, adding that the bank “was pleased with the state of the forex market”.

He said the bank was determined to achieve a convergence of rates in the market, a reason for its market interventions.

The naira was quoted at 305.70 to the dollar on the official market on Wednesday and 360 for investors, traders said, close to the the black market rate of 363 naira.

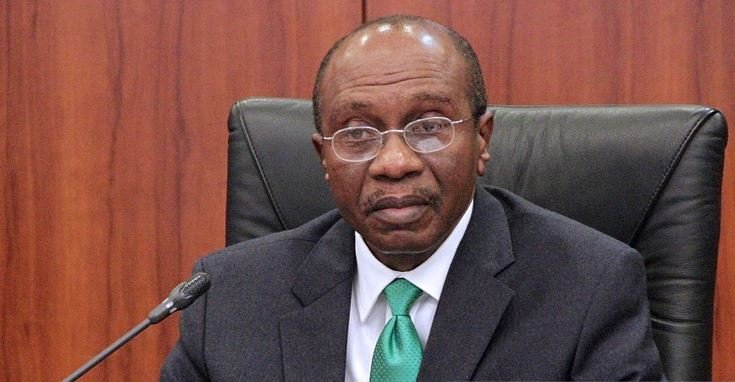

Last week, the CBN Governor, Mr Godwin Emefiele, said reducing interest rates may reverse the gains achieved in exchange rate stability and inflation rate reduction.

CBN has since resolved to consolidate on the gains made in post recession economy.