Business

CBN cuts benchmark lending rate to 12.5%

* Central bank cuts rate by 100 basis points

* Largest cut since 2015

* Governor says Nigeria may avoid recession

Central Bank of Nigeria (CBN) unexpectedly cut its benchmark lending rate to 12.5% from 13.5%, the central bank governor said on Thursday, to stimulate growth in Africa’s largest economy in the face of the coronavirus pandemic.

It is the first rate cut since March 2019 and the largest since 2015.

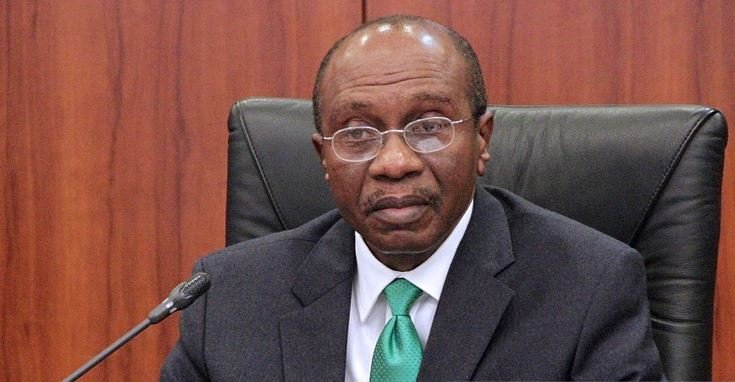

Seven of the 10 members of the bank’s monetary policy committee backed a 100 basis point cut, two voted for 150 basis points and one for 200 basis points, said the governor, Godwin Emefiele.

Africa’s top oil exporter faces economic distress from the coronavirus outbreak and sharp falls in crude prices, which have triggered a steep decline in growth.

Emefiele said the lower rate would “stimulate credit expansion to critically important sectors”, which in turn would also stimulate employment and revive economic activity for a quick recovery in economic growth.

Nigeria’s government expects the economy to contract by as much as 8.9% this year, but Emefiele said the country could avoid a recession.

He said the economy could contract in the second and third quarters but recover in the fourth with the fiscal and monetary policy measures put in place by the authorities.

The decision surprised analysts. The central bank has kept interest rates tight for the last two years to curb inflation, support the naira and attract foreign investors to its debt market.

“This is a surprise. Not least because, despite the central bank’s relative optimism on growth, the question is really around the potency of the MPR (monetary policy rate),” said Razia Khan, chief economist for Africa and Middle East at Standard Chartered Bank.

Annual inflation rose to 12.34% in April, its highest in more than two years, as measures to curb the pandemic hindered economic activity.

“The rate cut…means that we have negative real rates because of rising inflation,” Bismarck Rewane, head of Lagos-based consultancy Financial Derivatives, told CNBC Africa.