Nigeria has privitised its Bank of Agriculture (BoA) and wants farmers to prepare for the purchase of 40 per cent shares of the new financial institution.

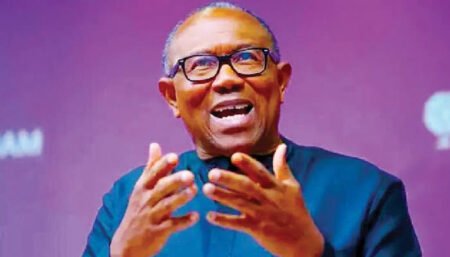

Chief Audu Ogbeh, the Minister of Agriculture and Rural Development, said that the privatization would help to create a viable and virile farmers’ bank like their counterpart in the Netherlands and China.

The minister explained that the Central Bank of Nigeria (CBN) and the Federal Ministry of Finance would own 20 per cent capital each while the private sector and investors would have 20 per cent shares.

According to him, farmers will have 40 per cent shares.

“We want to call on all farmers, old and new, male or female everywhere in Nigeria to prepare to buy shares in the Bank of Agriculture (BoA) when the sale opens.

“It is time to join in owning the farmers’ bank.

“Our administration, upon assumption of office, decided to take steps to stabilise, commercialise and partially privatise the Bank of Agriculture so it ceases to be wholly government bank constantly losing money.

“I decided that we needed to restructure the BoA to make it run more efficiently and like similar banks in Holland and China.

“We proposed this to the National Economic Committee, headed by the Vice President, Prof. Yemi Osinbajo.

READ: Model Tales Soares dies on stage during fashion parade

“Thereafter, the Bureau of Public Enterprise (BPE) took over and after several months, concluded the work.

“The Bank is expected to have a capital structure of N250 billion.

“CBN will own 20 per cent, Ministry of Finance- 20 per cent, private sector/corporate groups, including investors, will have 20 per cent and farmers will have 40 per cent shares.

“Our desire is to create a viable and virile farmers’ Bank like it exists in China and Holland,’’ the minister said.

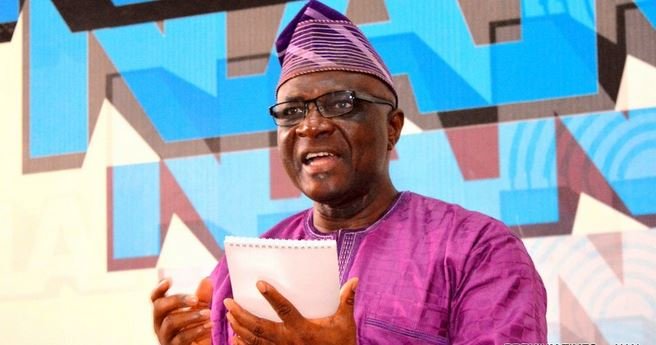

The Director-General of BPE, Mr Alex Okoh, had said that the privitisation process would be finalised in 90 days.