Banking

NDIC drags Ibeto to court over a disputed loan facility

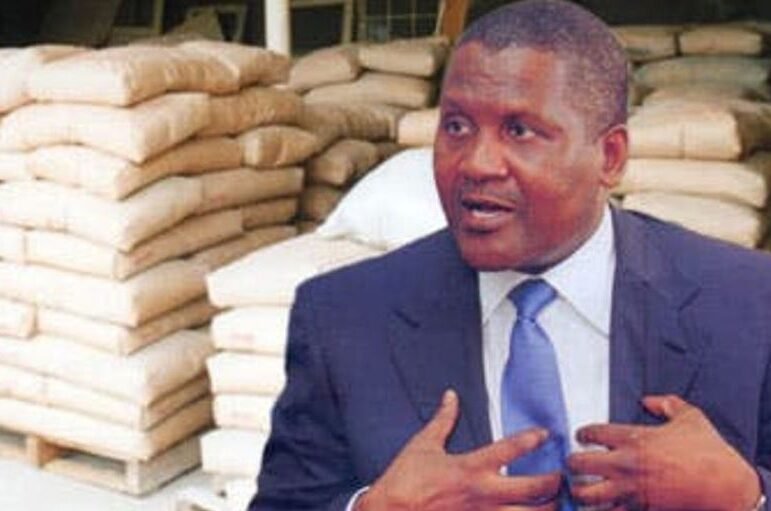

Cletus Ibeto, founder Ibeto Group

In a bid to recover a debt of N361,521,417.74 Nigeria Deposit Insurance Corporation, NDIC, (the liquidator of Metropolitan Bank Limited) has dragged a Nigerian businessman Chief Cletus M. Ibeto and his two companies Ibeto Petrochemical Industries Limited and Odoh Holding limited before a Federal high court in Lagos.

In an application for the recovery of debt filed before the court by the law firm of Joe kyari Gazama, it was alleged that on the 27th of May, 2003 Ibeto Petrochemical Industries Limited applied for and was granted a revolving Bankers Acceptance facility by defunct Metropolitan Bank Limited in the sum of N500 million.

The loan was secured by a deed of tripartite legal mortgage between Ibeto Petrochemical Industries Limited and Odoh Holdings Limited and Metropolitan Bank Limited.

The revolving bankers acceptance was drawn down and utilized by the Ibeto Petrochemical Industries Limited and was not repaid before the license of the bank was revoked by the Central Bank of Nigeria.

As at the closure of the bank on 16th of January, 2006 the company had an outstanding debt balance of N643,506,785.67.

READ: MultiChoice, ROK launch two new channels on DStv, GOtv

The respondents made a post closure payment in several installments between 2010 to 2011 totalling the sum of N243,233,089.16, the post closure payment was applied to reduce the outstanding bankers acceptance facility from N500million to N256,766,910.84.

Whereof NDIC claims against the respondents jointly and severally is the sum of N361,521,417.74 being total outstanding debt owed Metropolitan Bank in liquidation and together with accumulated interest as at the closure of the bank in January, 2006.

An order attaching the properties used by the respondents in securing the facility as may be sufficient in liquidating the outstanding debt.

An order granting the NDIC the right to exercise the power of sale over the properties.

However, in a reply and counter-claim filed on behalf of the respondents by a Lagos lawyer Barrister Ime Nya Asanga, the respondents averred that the facility subject matter of the applicant claim was granted to Ibeto Petrochemical Industries by the legacy Metropolitan Bank Limited, originally as a bankers Acceptance Facility which was subsequently converted by the said bank to a term loan at a reduced interest rate.

Notwithstanding the above, the bank in computing the respondents alleged exposure on the facility, continue to treat the same as bankers acceptance facility at horrendous interest rates and thus the unduly bloated the alleged debt.

The respondents have since 2011, on the prompting of the applicant, fully repaid the principal sum of the facility, therefore the respondents are not indebted or liable for any outstanding sum of 361,521,417.74, consequently having liquidation on the facility granted to the respondents in full, an order attaching the properties used by the respondents in securing the term loan granted cannot be made.

However in the counter-claim,the respondents are seeking the following reliefs; The issuance of deed of release of the properties used as security for the facility.

The payment of the sum of N550,026,685.85 being excess interest/charges as evident in auditor’s report.

The sum of N8million being the cost of defending and instituting the counter-claim.

The presiding judge, Saliu Saidu has adjourned till 10 April 2018 for hearing.