Business

NLNG begins talks with buyers on new contracts

Nigeria LNG (NLNG) has begun talks with potential buyers on new contracts for gas supplies from its first three production units at its liquefied natural gas (LNG) terminal, a senior official from the African company told Reuters.

Contracts for gas supplies from Trains 1, 2 and 3 – which together produce 9 million tonnes of LNG a year – are being discussed, said the official who requested anonymity.

He was attending the Gastech trade conference in Chiba outside Tokyo.

“Trains 1-3 are coming back to the market as they are out of contract by 2022. We started to remarket today,” he told Reuters late on Wednesday at the conference.

The units that freeze natural gas into liquid form for export on ships are known as trains in the industry.

Initial responses from buyers have been positive, he said.

“There are some who are guaranteed to buy,” the official said, though he provided no further details.

Nigeria LNG is a venture between state-owned Nigerian National Petroleum Corporation (NNPC), Royal Dutch Shell , Total and Eni.

Its Bonny Island LNG plant on Nigeria’s southern coast has six trains with a total capacity of 22 million tonnes a year.

Nigeria LNG Limited was incorporated as a limited liability company on 17 May 1989, to produce LNG and natural gas liquids (NGL) for export.

The plant was built by TSKJ consortium, which was led by former Halliburton’s subsidiary KBR. Other participants of the consortium were Snamprogetti, Technip and JGC Corporation.

The first train came into operation in 1999.

In September 1999, the Bonny plant started production and was expected to send its first shipment in October.

It started with sales contracts with Enel for 3.5 billion bcm/y, Enagás for 1.6 bcm/y, BOTAŞ for 1.2 bcm/y, and Gaz de France for 500 million cu m/year.

The feed gas was provided by Shell, Elf Aquitaine and Agip.

En 2013, NLNG signed an agreement with Samsung Heavy Industries and Hyundai Heavy Industries for the delivery of 4 LNG carrier ships that cost US$1.2 billion and that brought NLNG’s total fleet to 23 ships.

In 2015, NLNG reported a 36.6% drop in its revenue due to declining oil and gas prices (US$6.84 billion in 2015, US$10.8 billion in 2014).

2015 was the year that NLNG reached the threshold of US$85 billion of LNG exports in 15 years of business.

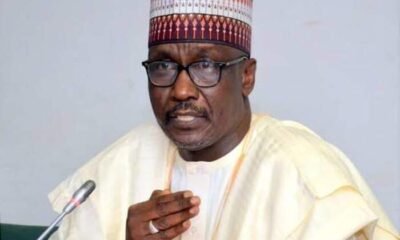

In July 2016, Tony Attah was named managing director and CEO of Nigeria LNG.

He repaced Babs Omotowa who led the company for 5 years and returned to Shell International in the Hague, Netherlands, after his departure.

In August 2016, Shell declared Force majeure on most of its feed gas to the facility after a gas leak on Shell’s Eastern Gas Gathering System (EGGS-1), but production kept going thanks to alternative sources of gas supplies.